「共働き妻を亡くした夫にも遺族年金を」訴訟 Lawsuit demands that husbands who have lost working wives be given survivor's pensions

「夫は仕事、妻は家事」という考え方を60年近く維持する法律があります。労災補償の遺族年金は、妻は年齢制限がないのに、夫は55歳以上でなければ支給されません。「男性が稼ぎ主」と決めつけて、男性と女性に差をつけることが許されるのでしょうか。ジェンダー平等のすすむ現代において、法律が憲法や国際法上の法の下の平等に違反することを訴え、差別なき社会を実現したいと考えています。 For nearly 60 years, there’s been a law upholding the notion of ”husbands work, wives handle household chores”. But while there’s no age limit for wives to receive survivor’s pension, husbands must be over 55. Is it fair to differentiate based on gender, assuming men are the breadwinners? We argue this law violates equality principles and strive for a discrimination-free society.

【2025年7月1日 目標金額を増額いたしました】

2024年4月のケースページ公開以来、多くのご寄付をいただき、当初の目標だった100万円を達成しました。皆様のご寄付のおかげで、複数の専門家意見書により充実した主張立証活動を行うことができました。心より感謝申し上げます。

ネクストゴールとして、さらに100万円を目指します。弁護団活動に必要な実費として用います。引き続きご支援のほど、どうぞよろしくお願いします。

*「労災遺族年金の「男女差別」撤廃を!訴訟」として公開されていたものと同一ケースです。

はじめに

原告は、労災で共働きの妻を亡くした男性です。妻が亡くなった当時、原告は51歳でした。

労働者災害補償保険法(労災保険法)は、男性が一家の稼ぎ主であることを前提として、夫が労災で亡くなった場合に妻の生活を補償するという考え方をベースにしています。

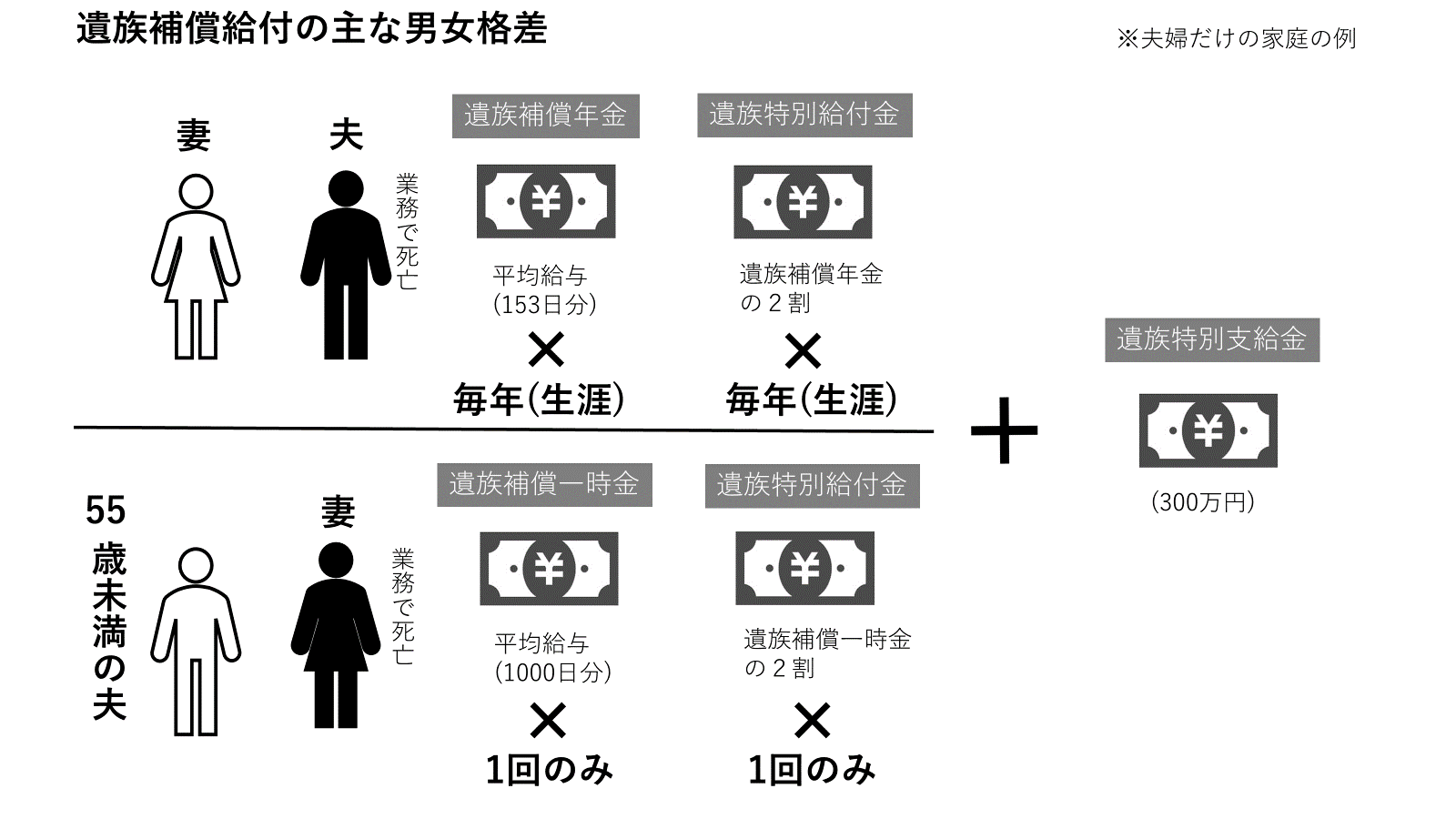

そのため、妻を亡くした夫より、夫を亡くした妻に手厚い給付をしています。

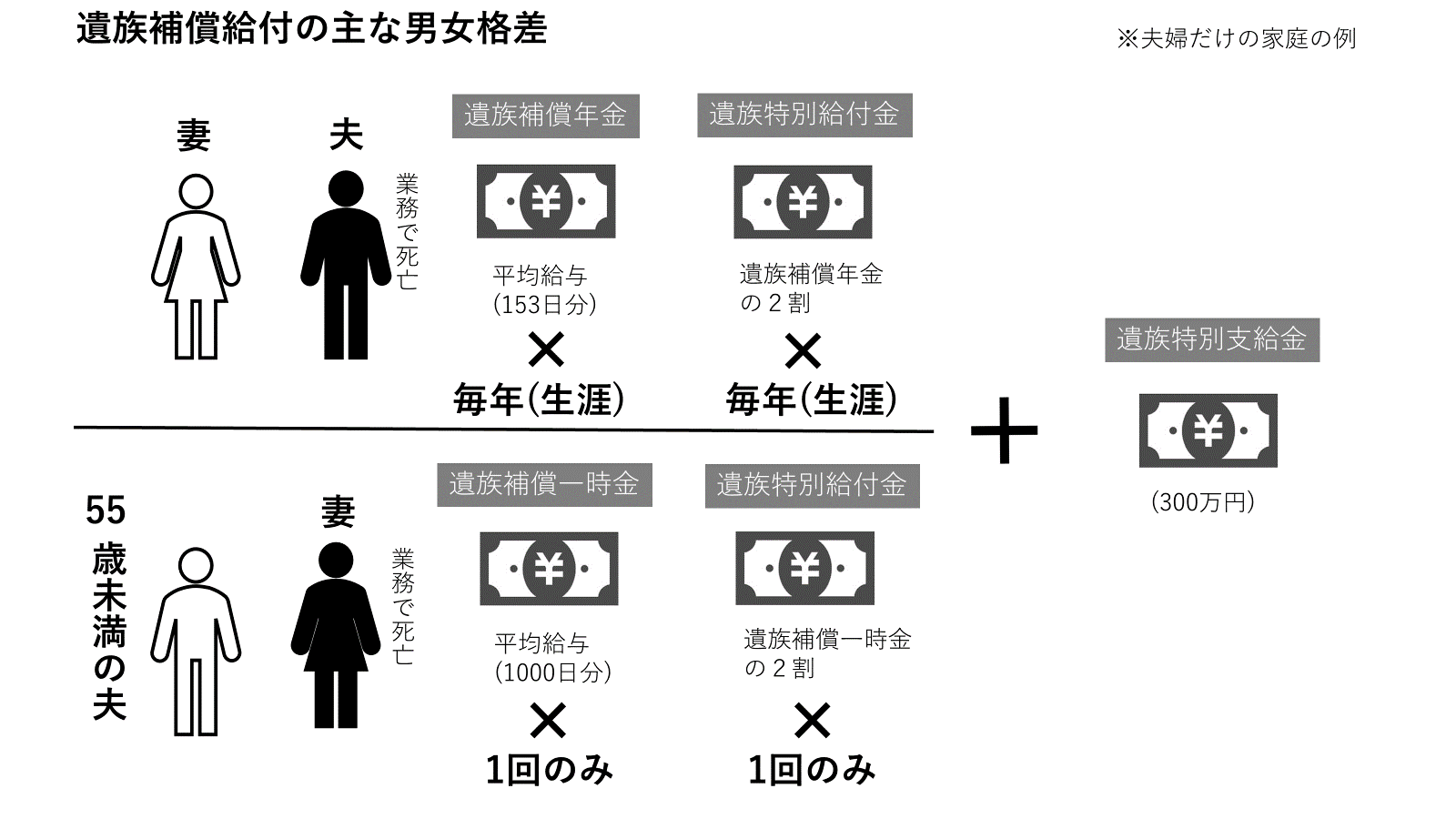

▶︎ 妻が遺族の場合、年齢に関係なく、遺族年金を受けることができますが、

▶︎ 夫が遺族の場合、妻の死亡時に55歳以上でないと、遺族年金を受けることができません。

1965年の法律施行当初、男性が専業主婦と子を養う《男性稼ぎ主モデル》が前提となっていました。しかし、60年近く経ち、共働きが当たり前となった今でも変わっていないのです。

共働き世帯や専業主夫世帯では、夫が妻を亡くしたとしても、限られた場合にしか遺族年金が支給されません。

原告は共働きで、妻が亡くなった当時に55歳未満であったため、遺族年金の支給を拒否されました。共働きが当たり前となった現代にふさわしい、共働き世帯にも平等な労災保障制度を求めています。

夫である原告Iさんへの遺族年金不支給

原告のIさん(仮名)は、妻と共働きで子ども3人を育ててきました。

Iさんの妻は、団体職員として勤務しており、Iさんより高収入を得ていました。妻は、忙しい部署へ異動となり、残業が増え、2019年6月にくも膜下出血で亡くなりました。2023年3月1日、妻の死は労災と認定されました。

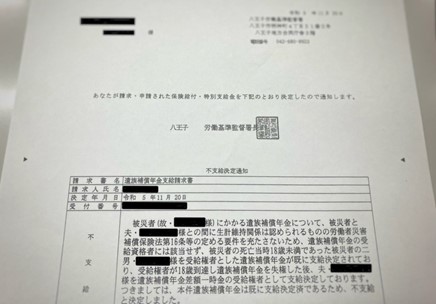

しかし、Iさんは、《夫》であり、《妻》死亡当時51歳であったため、遺族年金を受け取ることができませんでした。

もしも、法律が夫婦平等で、55歳という年齢要件がなければ、Iさんは遺族年金を受け取れたはずでした。

▲Iさんのもとに届いた遺族補償年金不支給決定通知

Iさんの妻が亡くなった当時、長男・長女は私立大学に通い、二男は中学3年生。

Iさんは、妻が生計を支えていた分を補うため、転職するなど大変な思いをして、なんとか家族の生活を支えました。

「《夫が亡くなった場合》と《妻が亡くなった場合》とで、国が給付の内容を変えるのはおかしい。」

「女性は社会に出て働こうと言うのに、昔のままの法律では、遺された子どもは夢を追えなくなってしまう。」

Iさんは、妻を亡くした夫がいる世帯にも、夫婦平等に遺族年金が支給されることを願い、裁判所に提訴することに決めました。労災保険法の規定が男女平等を定める憲法に違反すると考え、広く社会に知ってもらいたいと考えたのです。

▲2023年11月7日朝刊の朝日新聞

社会的意義

2011年、女性中学校教諭の在職中の自殺が公務災害と認められ、夫が本件と同様に遺族年金が支給されない法律の違憲性を問う裁判を起こしました。

一審の大阪地裁は、憲法14条1項に反し違憲無効と判断しましたが、二審の大阪高裁は、妻が「一般に独力で生計を維持することが困難である」として、合憲の判断をしました。最高裁も2017年に大阪高裁の判断を認めました。

しかし、性別のみを理由とした差別的扱いがあまりにも明確で、何らの社会的な妥当性も存在しない判決を、このまま放置することは断じてできません。

裁判の争点

この事件の争点は、労災事故で、

▶︎ 「夫」が死亡した場合 →妻は「生計維持関係」があれば遺族年金が受け取れる

▶︎ 「妻」が死亡した場合 →夫は「生計維持関係」に加えて、「年齢要件」か「一定の障害要件」を満たさない限り遺族年金は受け取れない

という労災保険法16条の2が、法の下の平等を定める憲法14条1項や、女子差別撤廃条約1条などに違反するかです。私たちは、以下の4つの観点から、この法律は憲法や条約に違反し無効であると考えています。

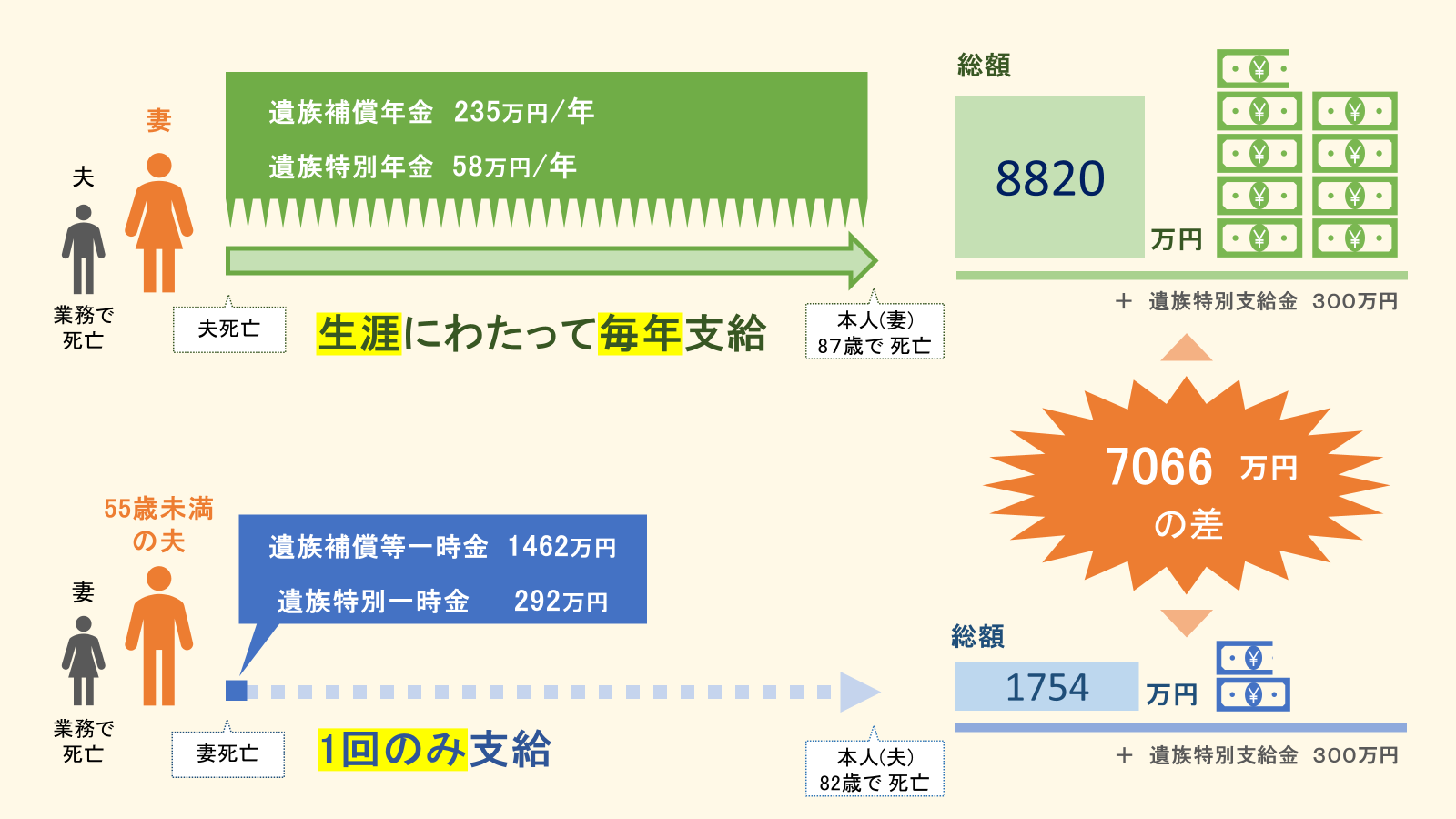

① 遺族補償の大きな経済格差

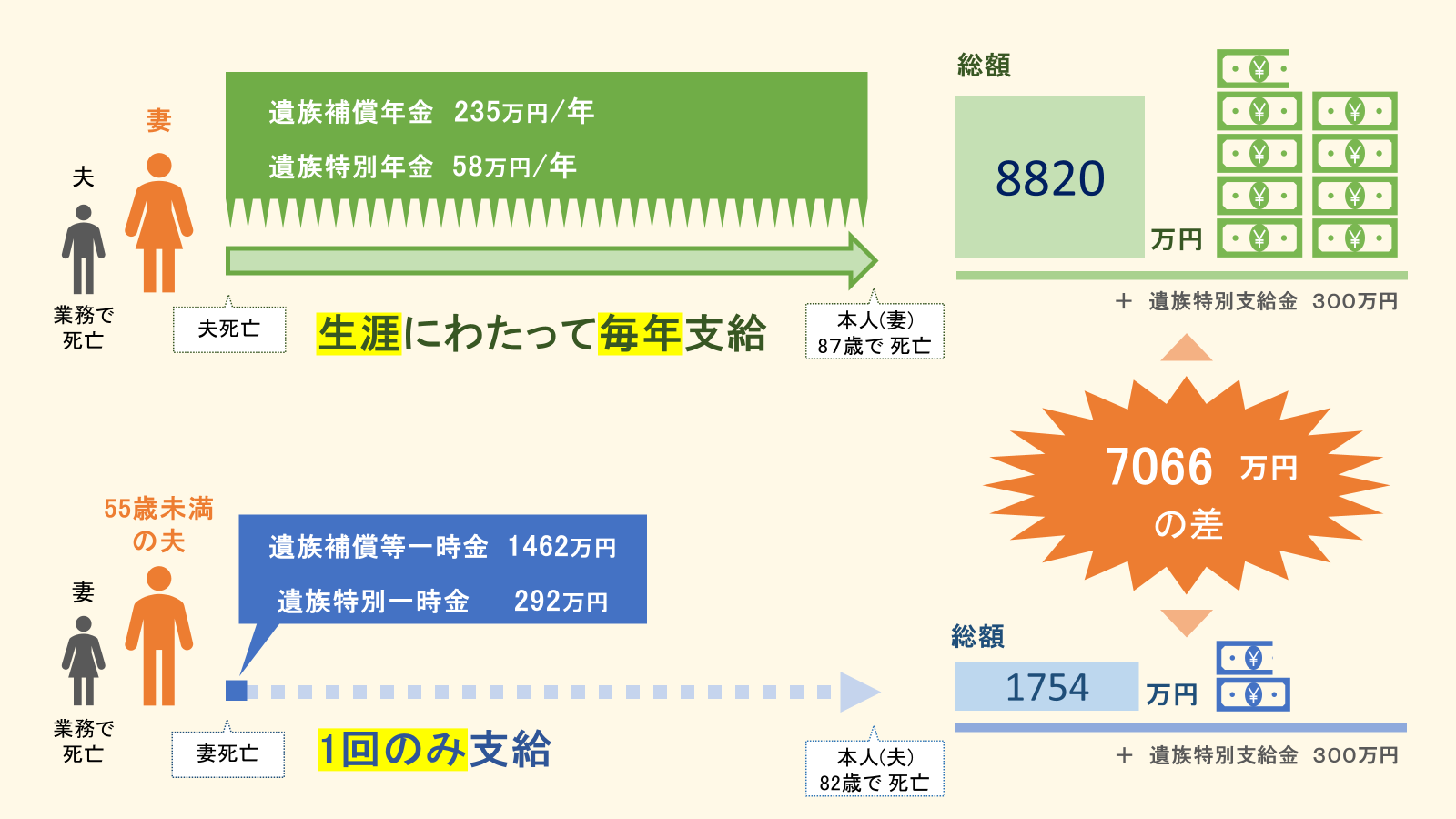

夫が死亡した女性(妻)が受け取る遺族年金の額は、妻が死亡した男性(夫)と比較して、約5倍になります。夫婦は平等であるはずなのに、遺族補償で5倍もの大きな格差を設けることは、働き手の女性を亡くした夫や子どもにとって大きな負担です。

*妻が死亡した場合に夫が受給する一時金と、夫が死亡した場合に妻が女性の平均余命である87歳まで生存すると仮定して受給できる遺族年金額を弁護団で試算

② 遺族である配偶者が被災者の死亡後に直面する変化

遺族である配偶者は、パートナーの死亡後、経済的な面でも家庭責任の面でも大きな変化に直面し、その負担の大きさに男女で違いはありません。

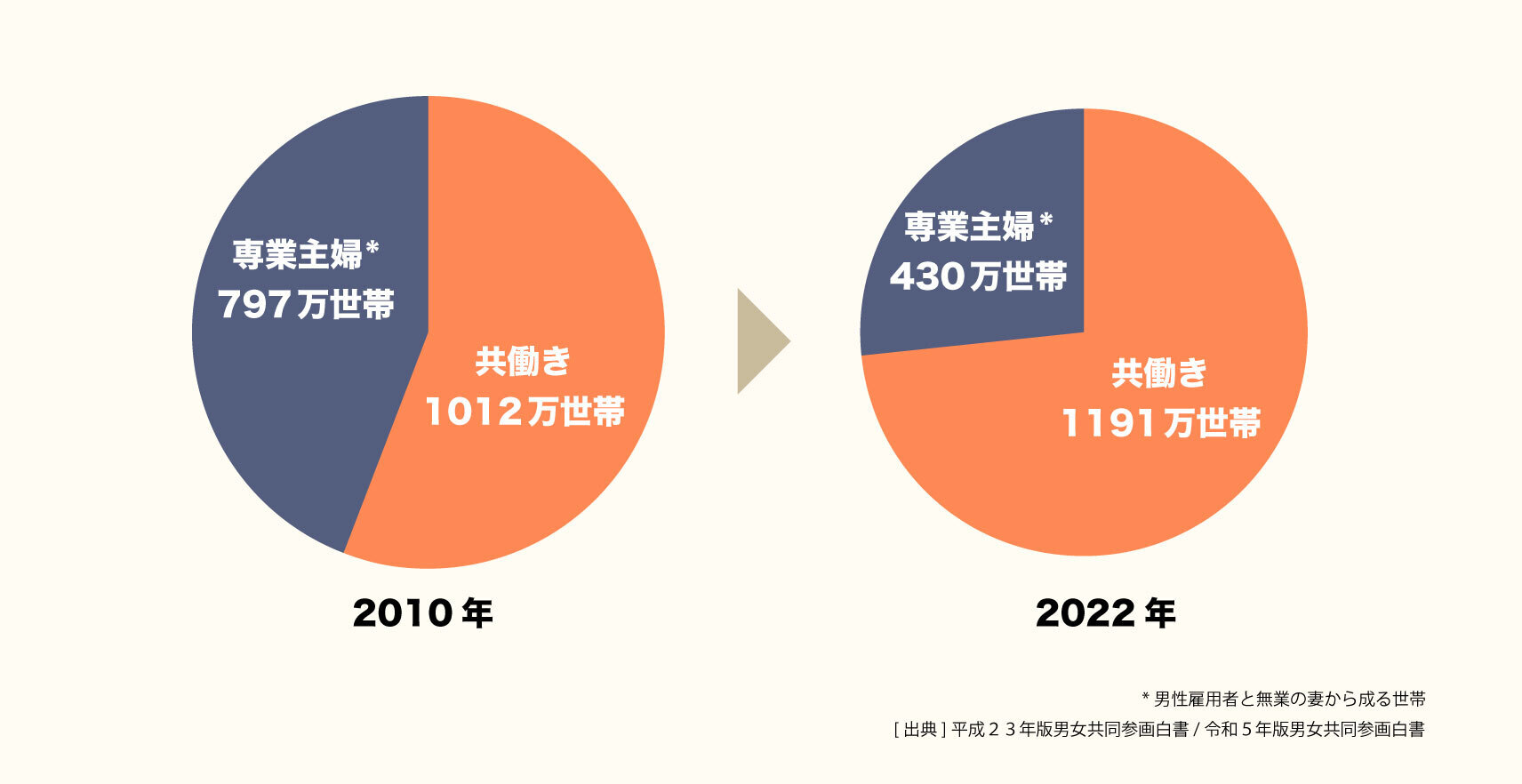

③ 共働き世帯が一般的な家庭モデルになっている

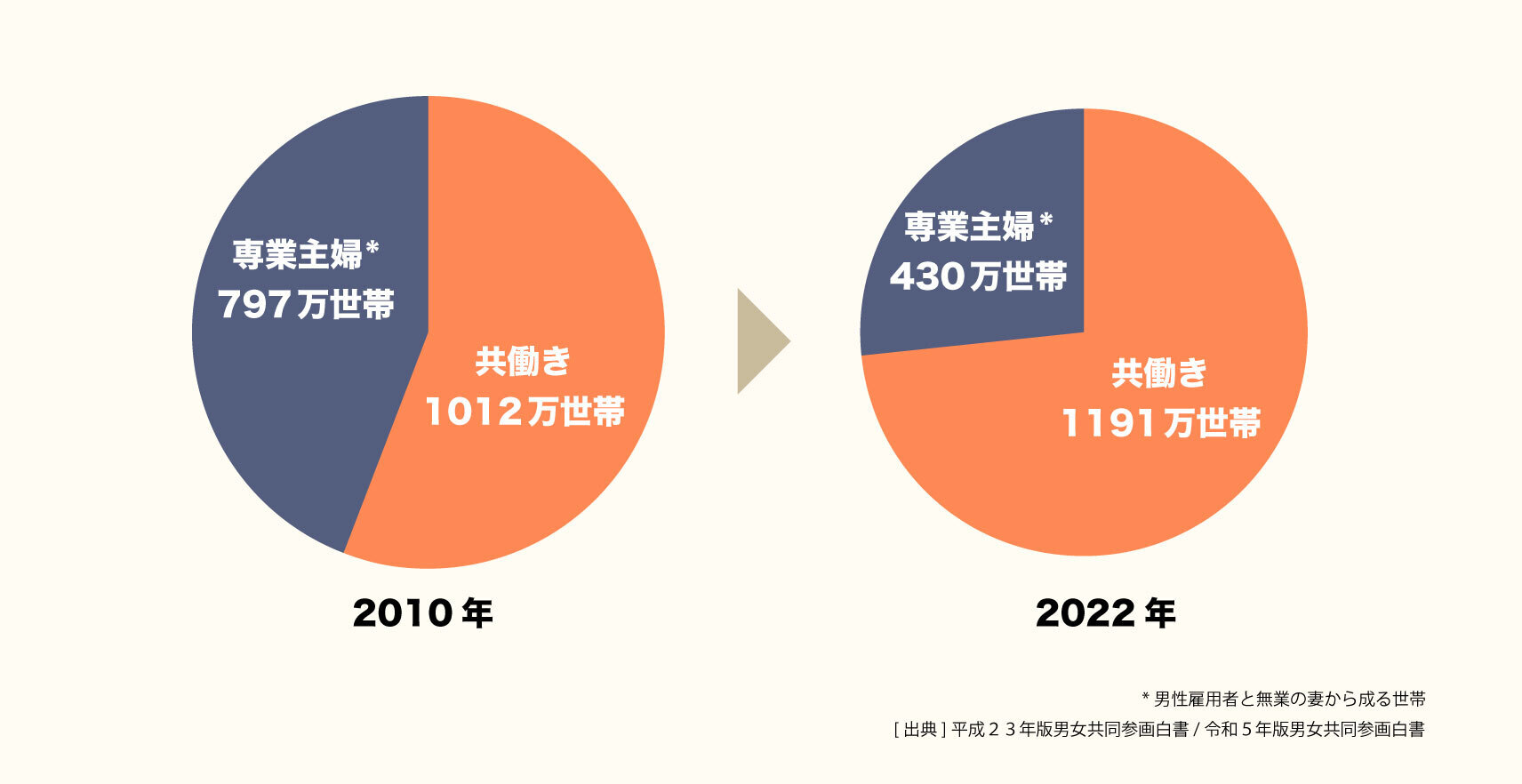

2010年 共働き世帯:1012万世帯、専業主婦世帯:797万世帯

↓

2022年 共働き世帯:1191万世帯専業主婦世帯:430万世帯となりました。

④ 夫婦平等の法改正の進展

2010年、母子家庭にしか支給されなかった児童扶養手当を、父子家庭にも支給することとする法改正が行われました。その際、政府は、「収入の低い一人親家庭に対する支援は男性か女性かを問わず必要」としています。

また、2024年現在、片働きを前提とする厚生年金の3号被保険者の見直しがすすめられています。

資金の使途

- 研究者や専門家の意見書作成費用

違憲判決を勝ち取るには専門家の意見書が欠かせません。国際法学者や憲法学者、社会保障法学者等の専門家に意見書を執筆していただきます。 - 印紙代(裁判所に納付する費用)、コピー代、通信費、弁護団の交通費

- この訴訟を社会に知ってもらうための費用

この訴訟の背後には、全国の共働き世帯の方々がいます。様々な団体と連携し、裁判の情報を発信したいと考えています。 - 弁護士費用

原告の思い

我が家では、夫婦共働きで、夫婦平等に家事を分担し、夫婦平等に子育てをしてきました。共働き世帯では、《夫が欠けた場合》でも、《妻が欠けた場合》でも、どちらも同じような打撃が、遺された配偶者や家族にもたらされます。

男女共同参画社会やジェンダー平等が謳われる現在、共働きや専業主夫が増え、収入、家事、子育てを分担しあう家庭はますます増えています。

このような現状で、《夫が亡くなった場合》と《妻が亡くなった場合》とで、国が行う給付の内容が異なるのはおかしいと思い、今回の訴訟提起をしました。

賛同や応援をいただければ大変幸いです。

担当弁護士のメッセージ

弁護団は、女性の労働と男性の労働が平等に評価され、共働き世帯の方々が平等に保護される社会に貢献したいと考えています。

どうかご支援のほど、よろしくお願い申し上げます。

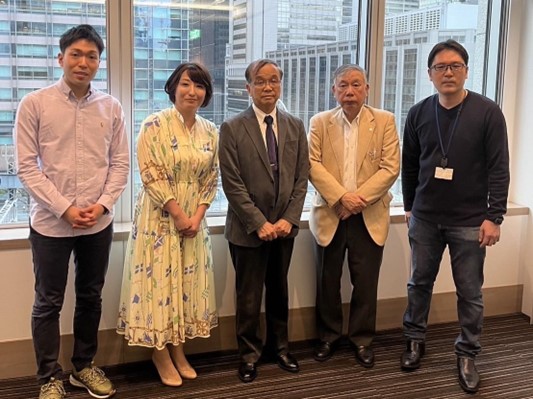

▲左から、川人弁護士、小野山弁護士、中西弁護士、蟹江弁護士

担当弁護士の紹介

川人 博 東京弁護士会

蟹江 鬼太郎 第二東京弁護士会

小野山 静 東京弁護士会

中西 翔太郎 東京弁護士会

松丸 正 大阪弁護士会

成見 暁子 宮崎弁護士会

私たちは、過労死弁護団全国連絡会議に所属し、過労死・過労自殺の労災認定や訴訟などの遺族救済、法制度等に関する意見の発出など、過労死問題に取り組んでいます。

*Traslated by google translate

[The target amount was increased on July 1, 2025]

Since the case page was published in April 2024, we have received many donations and have reached our initial goal of 1 million yen. Thanks to your donations, we have been able to carry out extensive claim verification activities through multiple expert opinions. We would like to express our sincere gratitude.

Our next goal is to reach another 1 million yen. We will use the money to cover the costs of our legal team activities. Thank you for your continued support.

*This is the same case that was made public as the "Lawsuit: Eliminate gender discrimination in workplace accident survivor pensions!"

Introduction

The plaintiff is a man who lost his working wife in a work-related accident. The plaintiff was 51 years old at the time of his wife's death.

The Workers' Accident Compensation Insurance Act (Workmen's Accident Compensation Insurance Act) is based on the premise that the man is the family's breadwinner, and is based on the idea that if the husband dies in a work-related accident, the wife's livelihood will be compensated.

That's why wives who lose their husbands receive more generous benefits than husbands who lose their wives.

▶︎ If the wife is the surviving family member, she can receive a survivor's pension regardless of her age.

▶If the husband is the surviving family member, he cannot receive survivor's pension unless he is 55 years old or older at the time of his wife's death.

When the law was first enacted in 1965, it was based on the premise that the man would be the main breadwinner, providing for the wife and children. However, nearly 60 years have passed since then, and even now, when dual-income households have become the norm, this has not changed.

In dual-income households or households with a stay-at-home husband, even if the husband loses his wife, survivor's pensions are only paid in limited circumstances.

The plaintiff was denied a survivor's pension because he was under 55 when his wife died, and both his spouses worked. He is seeking an equal workers' compensation system for dual-income households, appropriate to the modern era in which dual-income households have become the norm.

Non-payment of survivor's pension to the husband, Plaintiff I

The plaintiff, Mr. I (pseudonym), has been raising three children together with his wife, both of whom work.

Mr. I's wife worked as a corporate employee and earned a higher income than Mr. I. She was transferred to a busy department, which led to increased overtime work, and she died of a subarachnoid hemorrhage in June 2019. On March 1, 2023, his wife's death was recognized as an industrial accident.

However, since Mr. I was the husband and was 51 years old at the time of his wife's death, he was not able to receive survivor's pension.

If the law were equal for spouses and there was no age requirement of 55, Mr. I would have been able to receive survivor's pension.

▲Notice of non-payment of survivor's compensation pension received by Mr. I

At the time Mr. I's wife passed away, his eldest son and daughter were attending a private university, and his second son was in his third year of junior high school.

In order to make up for the financial burden his wife had been providing, Mr. I went through difficult times, including changing jobs, but he managed to support his family.

"It is wrong for the government to change the content of benefits depending on whether the husband dies or the wife dies."

"Women want to go out and work, but with outdated laws, their children will not be able to pursue their dreams."

Mr. I decided to file a lawsuit in court, hoping that survivor pensions would be paid equally to widowed husbands. He believed that the provisions of the Industrial Accident Compensation Insurance Act violated the Constitution, which provides for gender equality, and he wanted society to know about it.

▲Asahi Shimbun morning edition, November 7, 2023

social significance

In 2011, the suicide of a female junior high school teacher while on the job was recognized as a work-related accident, and her husband filed a lawsuit challenging the constitutionality of the law that did not provide survivor pensions, as in this case.

The Osaka District Court, at first instance, found the law unconstitutional and invalid as it violated Article 14, Paragraph 1 of the Constitution, but the Osaka High Court, at second instance, found it constitutional, stating that the wife "generally has difficulty maintaining her livelihood independently." The Supreme Court also upheld the Osaka High Court's decision in 2017.

However, this ruling is so clearly discriminatory based solely on gender and has no social validity whatsoever, and we simply cannot allow it to continue as it is.

Issues at issue

The issue in this case was a workplace accident.

▶︎ If the "husband" dies → The wife can receive a survivor's pension if she is in a "living-maintenance relationship" ▶︎ If the "wife" dies → The husband cannot receive a survivor's pension unless he meets the "age requirement" or "certain disability requirement" in addition to being in a "living-maintenance relationship"

The question is whether Article 16-2 of the Industrial Accident Compensation Insurance Act violates Article 14-1 of the Constitution, which provides for equality under the law, and Article 1 of the Convention on the Elimination of All Forms of Discrimination against Women. We believe that this law violates the Constitution and treaties and is invalid for the following four reasons.

① Large economic disparities in survivor compensation

The amount of survivor's pension received by a woman (wife) whose husband has died is about five times that of a man (husband) whose wife has died. Although husbands and wives are supposed to be equal, creating such a huge disparity in survivor's compensation is a heavy burden on the husbands and children who lose working women.

*The legal team calculated the lump sum that a husband would receive if his wife died, and the amount of survivor's pension that a wife would receive if her husband died, assuming that she survives to the average life expectancy of a woman, age 87.

② Changes that bereaved spouses face after the death of a disaster victim

Surviving spouses face significant changes in both finances and household responsibilities after the death of their partner, and the burden is felt equally by men and women.

3) Dual-income households have become the typical family model

2010: Dual-income households: 10.12 million households, Full-time housewife households: 7.97 million households↓

In 2022, there were 11.91 million dual-income households and 4.3 million full-time housewife households.

④ Progress in legal reform for marital equality

In 2010, the law was amended to allow child-rearing allowances, which had previously only been paid to single-mother households, to be paid to single-father households as well. At the time, the government stated that "support for low-income single-parent families is necessary regardless of whether the parent is male or female."

In addition, as of 2024, a review of the Employees' Pension Insurance Category 3 insured person, who is based on the assumption that one spouse is working, is underway.

Use of funds

- Costs for writing opinions by researchers and experts <br>An expert opinion is essential to winning a ruling that the law is unconstitutional. We ask experts such as international law scholars, constitutional law scholars, and social security law scholars to write opinions.

- Stamp fees (fees paid to the court), copying fees, communication fees, and travel expenses for the legal team

- Costs for raising awareness of this lawsuit in society <br>Behind this lawsuit are dual-income households from all over the country. We would like to work with various organizations to spread information about the trial.

- Attorney's fees

Plaintiff’s thoughts

In my home, both my husband and I work, and we share the housework equally and raise our children equally. In a dual-income household, whether the husband is absent or the wife is absent, the surviving spouse and family suffer the same blow.

In today's world, where men and women are equally involved and gender equality is being touted, the number of dual-income households and stay-at-home husbands is increasing, and the number of families in which income, housework, and child-rearing responsibilities are shared is on the rise.

Given the current situation, I believe it is wrong that the benefits provided by the government are different when a husband dies and when a wife dies, and so I filed this lawsuit.

I would be very grateful for your approval and support.

Message from the lawyer in charge

Our legal team wants to contribute to a society in which women's work and men's work are valued equally and dual-income households are equally protected.

We would be grateful for your support.

▲From the left, Attorney Kawato, Attorney Onoyama, Attorney Nakanishi, Attorney Kanie

Introduction of the lawyer in charge

Hiroshi Kawato Tokyo Bar Association Kitaro Kanie Second Tokyo Bar Association Shizuka Onoyama Tokyo Bar Association Shotaro Nakanishi Tokyo Bar Association Tadashi Matsumaru Osaka Bar Association Akiko Narimi Miyazaki Bar Association

We belong to the National Liaison Conference of Lawyers for Death from Overwork, and are working on the issue of death from overwork, including certifying death or suicide from overwork as an industrial accident, providing relief to surviving families through lawsuits, and issuing opinions on the legal system, etc.

あなたにおすすめのケース Recommended case for you

- 外国にルーツを持つ人々 Immigrants/Refugees/Foreign residents in Japan

- ジェンダー・セクシュアリティ Gender/Sexuality

- 医療・福祉・障がい Healthcare/Welfare/Disability

- 働き方 Labor Rights

- 刑事司法 Criminal Justice

- 公正な手続 Procedural Justice

- 情報公開 Information Disclosure

- 政治参加・表現の自由 Democracy/Freedom of Expression

- 環境・災害 Environment/Natural Disasters

- 沖縄 Okinawa

- 個人情報・プライバシー Personal information/Privacy

- アーカイブ Archive

- 全てのケース ALL